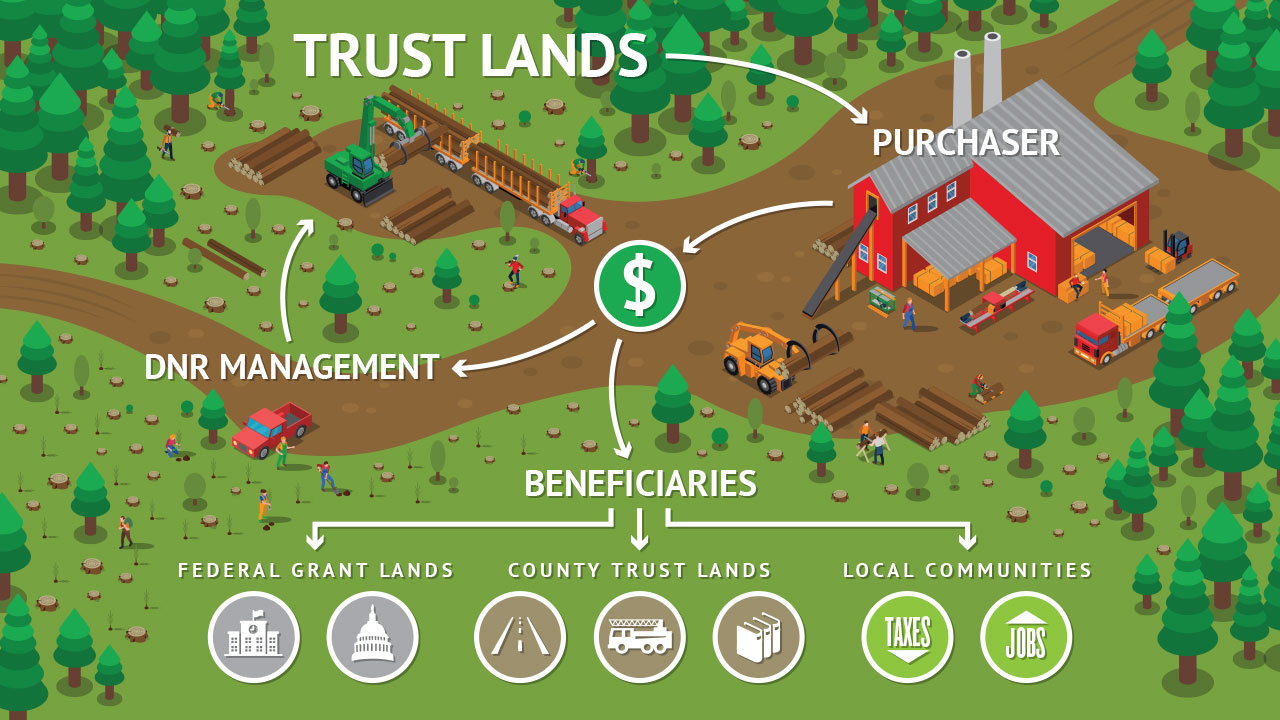

Trust Land Revenue

The Washington Department of Natural Resources (DNR) is required by state law to sustainably harvest timber on forested state trust lands to generate revenue for beneficiaries, including schools, universities, hospitals, and more. Additionally, the DNR generates revenue for the beneficiaries on non-forested lands as well, including agricultural and commercial properties. Today, those lands generate nearly $200 million in timber revenues annually.

The DNR retains a management fee for the work the Department does to manage trust lands. By state statute, the management fee is limited to 25% of revenue, or in other words for every dollar DNR brings in, the Department retains $0.25 for management costs and the beneficiaries receive $0.75. However, for the last several biennia, the DNR has received approval for a higher cap in management fees through budget provisos. Currently, the cap on Federally Granted trusts is set and 32% and for County Trusts the cap is 27%. The Board has approved a rate of 31% and 25% respectively.

Federal Grant Lands

Revenue from trust lands is used for a variety of purposes depending on the trust. The Capitol Building trust for example uses the funds to maintain the State Capitol and its associated buildings in Olympia. The Common School Trust, the largest, deposits revenues into the state’s Common School Construction Account. The money is then distributed out to school districts who apply to the Office of Public Instruction and are approved for funding to assist with remodeling or construction of new schools. However, for lands in eastern Washington, to help fund and accelerate forest health work, revenue from eastern Washington trust timber lands are deposited into the Forest Health Revolving Account. This account is capped at $10 million and funds both commercial and non-commercial work on east side trust lands.

County Trust Lands

Revenue from “County” Trust Lands, specifically State Forest Transfer Lands, which makes up the majority of the “County” trust lands, can be a little more complicated in how they are dispersed. Since, these lands once were private lands and paid property taxes to the taxing district they were in, timber revenues are handled much in the same way. The distribution of revenue is determined by the tax code area where a timber sale occurs. The “millage rate” or “per thousand rate” of each Junior taxing District in the tax code area, helps determine the percentage of the total revenue each junior taxing district receives. The county serves as a fiscal agent for DNR and receives the gross timber revenue, calculates the individual payments for each Junior, and then distributes that money to the junior taxing district. Ultimately, these funds go to support services such as county roads, fire and EMS, libraries, hospitals, and many others.

Forest Excise Tax

An additional revenue stream for many beneficiaries of sustainably harvested timber from DNR managed trust lands is the Forest Excise Tax. Sometimes, you may hear this also referred to as the severance tax. This tax applies to the harvest of timber from both public and private timberlands in Washington State. The 5% tax on stumpage (stumpage is the price a purchaser pays for standing timber after all costs such as road building, logging and hauling, are removed) is collected by the State Department of Revenue and approximately 4.5% is distributed to the county where the timber was harvested. This money is then distributed much the same way as property tax payments would be and is similar to the way timber revenue from “County Trust” lands is distributed as described above.

Other Economic Benefits

Sustainable management of forest trust lands provides other direct and indirect benefits for the beneficiaries and local communities, beyond timber sale revenue. The primary benefit is the economic activity and jobs created by the management of these lands. The Forest Products sector accounts for the majority of these jobs. These jobs are typically considered direct or indirect employment.

Direct employment would be the foresters, loggers, truck drivers, and other job classifications that directly engage in the management, harvesting, and planting of these lands, as well as the workers in the manufacturing facilities such as the many mills that buy and process timber sold by DNR. The indirect employment is represented by the jobs that help support the direct employment operations. These jobs are typically found at companies who help support the logging, trucking, and milling operations. Mechanic services, tire sales, fuel delivery, logging equipment supplies, and many others are considered indirect employment but have a clear connection to the forest products sector.

A third category of employment related to management of trust lands is called induced employment. These are the type of jobs that are created through the broader economic activity of the direct and indirect employment. Restaurants, grocery stores, convenience stores, gas stations, hardware and lumber stores, and the many other types of businesses where the money earned in the direct and indirect jobs is spent. While not directly related to the forest products sector, these jobs are supported partially by the management of trust lands. In many rural communities where forestry is a major employer these induced jobs are much more closely tied to the direct and indirect jobs.

A common metric for expressing the number of jobs created from timber harvesting is the number of jobs per 1 million board feet of timber harvested. In the Pacific Northwest there are about 12 direct and indirect jobs per 1 million board feet harvested. Based on the FY15-24 Western Washington Sustainable Harvest Volume of approximately 467 million board feet per year, means the DNR timber sale program supported about 5,600 direct and indirect jobs just from the western Washington harvest. Using the 18 jobs per million board feet value that DNR published in its 20-year Forest Health Strategic Plan, supports about 9,000 jobs across Washington State based on its average of sale program of 500 million board feet per year. These jobs help to support the economic stability and resiliency in many rural communities. Indirectly, benefit the local schools and other public services as well as the many small and large businesses in those communities.